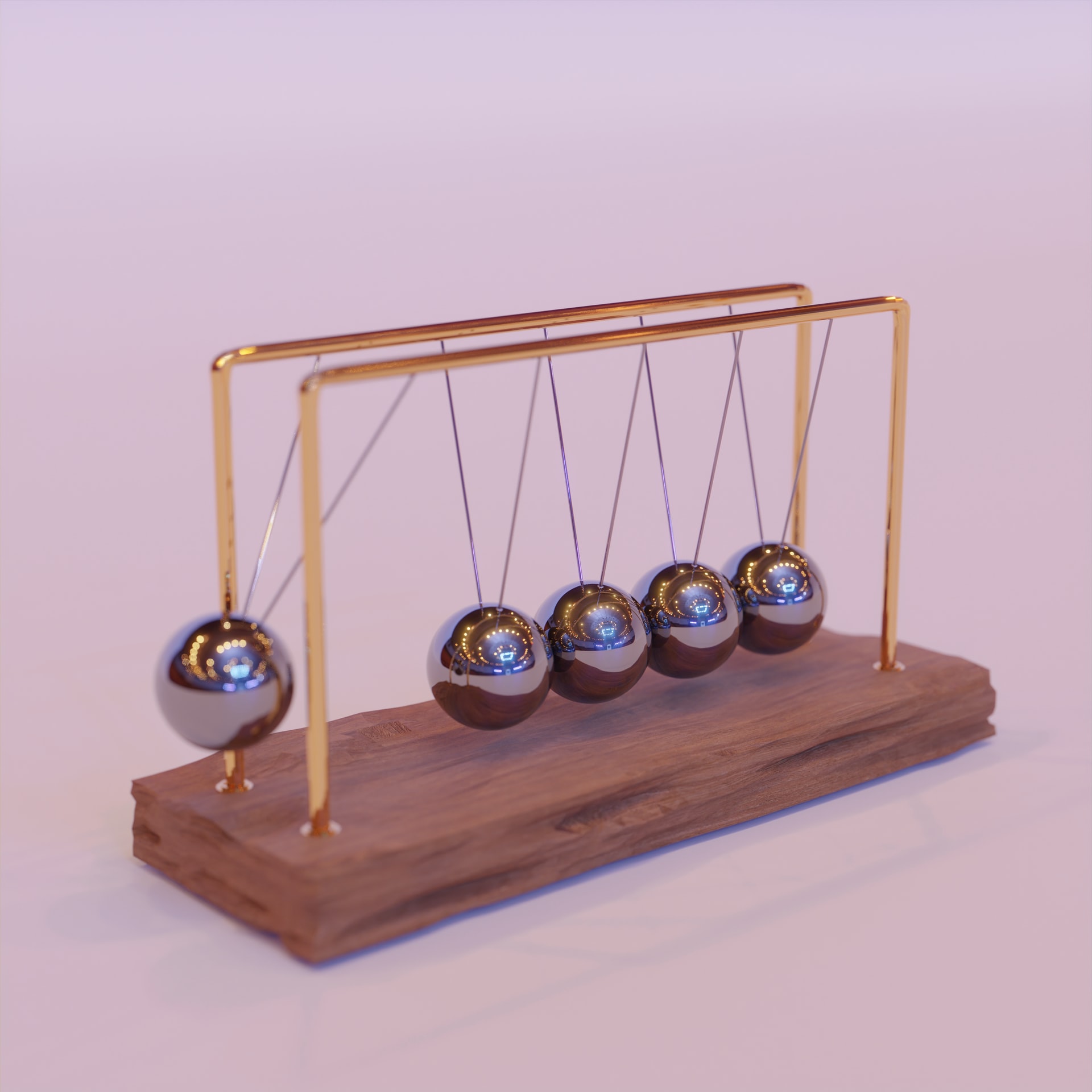

Would you try to walk upside down with your feet on the ceiling? Sounds like science fiction or camera trick. Breaking the laws of physics sounds crazy and the brave ones who to try defying physics pay the cost with few broken bones. And despite being oblivious to Newton’s laws and Einstein’s equations, most of us tacitly accept the limitations and seldom try to mess with the laws of physics. Although some might argue that these laws are limitations that stop us from accessing another dimension, or perhaps a state, I believe that they have done a godly job at maintaining sanity and order in our Universe.

Just as the laws of physics maintain order to our physical existence, so do financial rules in the world of business. However, the laws are physics are universally accepted; whereas the rules are finance are often bent and challenged. But, most importantly, I feel that they are neither appreciated enough nor acknowledged widely. These rules serve as fundamental norms that keep a capitalist economy from becoming an anarchy driven by self interest. These financial rules in conjunction with principles of economics maintain sanity and order.

Although man has traded since the dawn of civilisation, Finance is a much younger science compared to Physics and Chemistry. Another challenge is that unlike other natural sciences, in Finance we do not have the guidance of Mother Nature. Physics, can be termed as an interpretation of the events occurring in the nature with an ultimate goal to derive empirical heuristics that can be used to predict the events in nature. Whereas, Finance and Economics are completely man-made and we are still learning from our successes and failures. In the recent decades, we have learned from experimental economic policies of Japan, the dot com bubble, the housing market collapse, the delusions of start-up valuations, currency manipulation, negative crude oil prices, and many more.

Now you might be curious about these rules. Let us understand them by drawing parallels between a few. Just as time cannot be negative, cash cannot be negative. And just as the gravity laws determine the interaction with objects with mass so do the economic principles of demand and supply between buyers and sellers. Although any matter or particle cannot defy laws of physics, certain entities try to defy or circumvent the rules of finance. But unlike the immediate reward of broken bones, the consequences that result from such attempts are not immediately apparent.

The impacts accumulate over time and consequences surface only after the point when the bubble can no longer withstand the pressure. Whether it is lucrative equity value of loss making enterprise inflated through optimistic valuation rounds or the bolstered GDP figures of a tanking economy supported by quantitative easing. Unless the core challenges are addressed such measures of playing by the rule, only postpone the impending fiasco to a later date. In the corporate terminology, it is called ‘not under my watch’, as the one who is incharge at the time when the bubble bursts will only face the consequences while the other have already taken their golden parachutes.

As we conclude this blog, leaving you with a fair warning, treat the rules of finance and principles of economy at par with laws of physics and always be aware of what kind of parcel you are holding as CEO or CFO, as once the music stops, you will have all eyes on you!

Header Image Photo by Sunder Muthukumaran on Unsplash

1 Comment

Comments are closed.